Gold has traded between $1,157 and $1,179 so far today…as of 10:30 am Pacific, bullion has recouped most of its losses from earlier in the morning…it’s now down just $2 an ounce at $1,175…Silver, at $16.78, has gained 6 cents…Copper has jumped 7 pennies to $2.68…Nickel has added another 11 cents to $5.24…Crude Oil is up 24 cents to $51.92 while the U.S. Dollar Index has tumbled more than a full point to 100.02…

The rotation out of precious metals into industrials continued this morning when Gold came under further pressure from liquidation of longs in futures and ETFs ahead of next week’s Fed meeting…key technical support is around $1,150, so it wasn’t surprising to see the market reverse higher after dropping into the upper $1,150’s…support could be tested again, or it’s possible we may have seen a bottom today…

The rotation out of precious metals into industrials continued this morning when Gold came under further pressure from liquidation of longs in futures and ETFs ahead of next week’s Fed meeting…key technical support is around $1,150, so it wasn’t surprising to see the market reverse higher after dropping into the upper $1,150’s…support could be tested again, or it’s possible we may have seen a bottom today…

Investors sold metal from exchange-traded funds for a 16th straight day Friday, the longest run since March 2015, and that selling certainly carried over to this morning…holdings are at their lowest levels since June, according to data compiled by Bloomberg…

Four Stocks Lead The Dow

The Dow hit another new record high this morning of 19275…through last Friday, the 1,200-point gain in the Dow in just 1 month has been fueled by just 4 stocks…leading the field by a wide margin is Goldman Sachs (GS, NYSE)…the stock’s 26.5% rally over the past month has added about 320 points to the Dow…in second place is UnitedHealth (UNH, NYSE) which is up about 16%, adding another 150 points to the 30-stock index…meanwhile, Caterpillar’s (CAT, NYSE) 17.3% run has added about 95 points, just ahead of JPMorgan’s (JPM, NYSE) 90-odd point contribution…combined, the 4 stocks have accounted for 55% of the Dow’s 1,200-point climb…

How “Rich” People Think

How do the “Top 1%” think differently, and what can the other 99% learn from them? (rather than demonize them, as certain politicians and others like to do in both Canada and the United States)…

Self-made millionaire Steve Siebold spent 26 years interviewing some of the wealthiest people in the world before boiling down his findings in the book, “How Rich People Think“…he found that there are countless ways the rich view the world differently – they have different beliefs, philosophies and strategies…

Perhaps the most striking difference is that rich people believe money is earned through thinking, while the average person believes money is earned through time and labor…

High earners believe money flows from ideas and finding solutions to universal problems, he says: “The bigger the solution, the bigger the paycheck…making money may not be easy, but it is simple”…

Obama Throws Wrench Into Dakota Access Pipeline, B.C. Oil Haters Cheer

The Obama administration said yesterday that it had denied a permit needed to complete the last leg of an Oil pipeline across the Midwest, prompting cheers from opponents but warnings that the move could be short-lived since President-elect Donald Trump supports the project…

The nearly 1,200-mile Dakota Access pipeline, extending from North Dakota across parts of South Dakota and Iowa and ending in Illinois, is nearly complete, except for an 1,100-foot crossing of a Missouri River reservoir…

Protesters led by the Standing Rock Sioux Tribe have been gathering for months near Cannon Ball, N.D., close to the site of the crossing at Lake Oahe, and have argued that the pipeline endangers the tribe’s water supply and sacred sites…the pipeline’s builder, Dallas-based Energy Transfer partners LP, has completed all necessary permitting requirements for the project and says it has worked to minimize any damage to traditional sites and the risk of an Oil spill…

Eco-fascists in British Columbia, preparing to protest against the recently approved Kinder Morgan Trans Mountain pipeline expansion, were quick to cheer yesterday’s White House decision…

B.C. Grand Chief Stewart Phillip says the decision serves as a “beacon of hope” for those in B.C. who are opposed to the project. “The incredible solidarity that arose in support of the Standing Rock Sioux tribe will serve to inspire us here on the west coast of British Columbia to convey the notion that together all British Columbians can work together successfully.”

We’re not sure what Chief Phillip actually means by that…unfortunately, for those who have embraced the new religion of eco-fascism in B.C. and elsewhere, “compromise” is not part of their vocabulary…they are vehemently opposed to the flow of Oil, period, no matter how low the “risks” are…Trans Mountain has been given the go-ahead and those who choose to engage in civil disobedience in a way that impedes the development of this project, one of national importance to Canada’s Oil industry and economy, ought to be arrested and thrown in jail…

Crude Oil Update

The 20% rally in Brent Crude since last Wednesday’s OPEC agreement is the strongest over 4 days in almost 8 years…from January, non-OPEC producers are expected to add an output cut of 600,000 barrels per day (bpd) to the cartel’s agreed 1.2 million bpd reduction…

However, one large uncertainty in the global supply balance is output from the United States, whose shale Oil drillers proved more resilient than expected to weak Oil prices…U.S. energy firms extended their recovery in Oil drilling into a 7th month last week, according to data from energy services firm Baker Hughes (BHI, NYSE)…

Overall, accounting for the recent rise in Oil drilling, but also for cutbacks earlier this year on low prices, Goldman Sachs predicts that “year-on-year production will decline by 620,000 barrels per day (bpd) in 2016 and increase by 55,000 bpd in 2017“…in other words, the U.S. is not expected to be a major source of new supply next year…

WTIC 15-Month Weekly Chart

Crude Oil has moved a lot over the last 4 sessions but even higher prices do appear to be on the way when one examines this 15-month weekly chart…

The key pattern since the summer of 2015 has been an “inverted head-and-shoulders” with the “head” of course representing the bottom in the upper $20’s in early February of this year…the right shoulder has been forming since the summer, and Oil is now just beginning to gain traction above the “neckline” at $50…this could trigger a wave of technical buying before year-end…

Ultimately, based on this chart as well as improving fundamentals, we continue to maintain that Crude Oil has an excellent chance to push into the $70’s during the 1st half of next year…

Venture Seasonality Chart

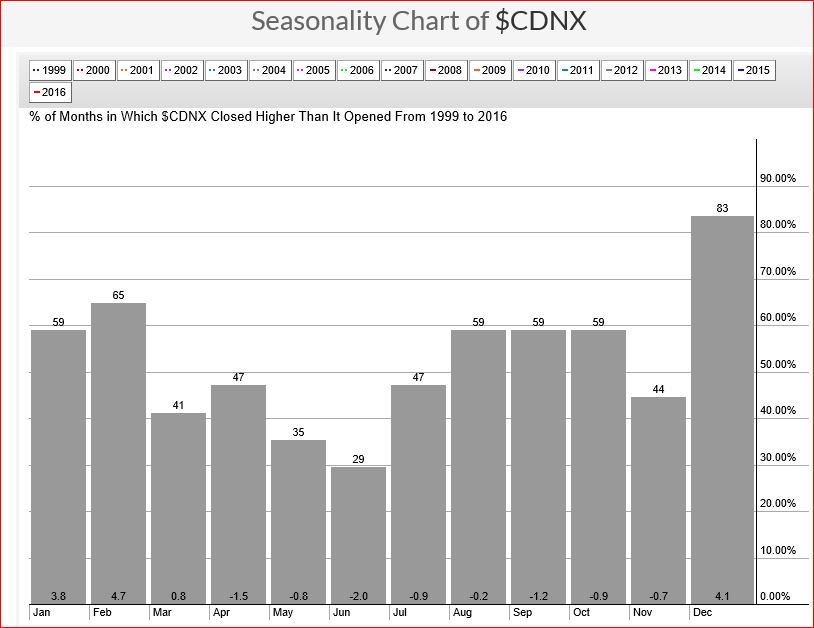

Based on historical data, the Venture has an 83% chance of finishing the month higher than November’s close of 737…

Going back more than 15 years, the December-January-February period is the Venture’s strongest with a total gain of 12.6% during those 3 months…in bull market times, as we’re in now, the advance tends to be much greater…

In short, this is the best time on the calendar to be a buyer!…

In Today’s Morning Musings…

1. Bullish CRB Index – key levels to watch for a potential major breakout…

2. Evidence of a bottom in Silver – updated chart…

3. Kootenay Silver (KTN, TSX-V) update…

4. Daniel’s Den – Vancouver’s “Uber of Banking”, trading on the TSX…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

BullMarketRun.ca

BullMarketRun.ca

GDM – look at the volume and increase in SP. News close on this one.

Comment by Dan1 — December 5, 2016 @ 11:20 am

Daniel – check out another fintech. FGD.V – just found out about it. It has gone up to much for my blood as I only buy at bottoms.

Comment by dave — December 5, 2016 @ 11:28 am

GDM – at a tripple top of .08, be interesting to see what it does from here. stockta shows .08 last resistance. requested chart from stockcharts.

GGI – .13 last resistance. Barcharts rating a strong buy.

Comment by dave — December 5, 2016 @ 11:33 am

Also, GGI, macd cross and a golden cross.

Comment by dave — December 5, 2016 @ 11:35 am

GGI – Feels like a financing about to happen. They do need cash to move these projects forward and there hasn’t been a financing in quite some time.

Comment by Dan1 — December 5, 2016 @ 1:11 pm

Jon: you have mentioned the 1000 level as 2016 target for the TSX Venture multiple times throughtout the year. What are your thoughts now as we end 2016 and we are 250pts away from that? any chance or? Thanks!

Comment by STEVEN1 — December 5, 2016 @ 7:53 pm

Next measured Fib. resistance, Steven1, is 976 – certainly possible in Q1. Looks like the low in this correction was 717. Venture will be back above 800 by year-end and that sets things up nicely for the run to 1000 which won’t be the high in this cycle.

Comment by Jon - BMR — December 5, 2016 @ 9:37 pm

Really nice results from PRB this morning, explains why they’ve doubled the size of Val d’Or East recently…significant new high-grade discovery at depth in a diorite dike, similar to the adjacent past producing Beliveau mine…

Dr. David Palmer reports

PROBE METALS DISCOVERS NEW HIGH GRADE GOLD ZONE ON VAL-D’OR EAST PROJECT: INTERSECTS 12.6 G/T GOLD OVER 7.3 METRES

Probe Metals Inc. has released results from the continuing drilling program on its 100-per-cent-owned Val d’Or East project located in Quebec. In addition to further definition and delineation of the east-west-trending gold-bearing quartz-tourmaline vein system, drilling was also successful in discovering a new high-grade gold zone hosted by diorite dike, similar to that of the past-producing Beliveau mine.

Highlights from new drilling include:

Discovery of a new high-grade gold zone in diorite dike returning intervals of up to 12.6 grams per tonne gold over 7.3 metres in hole PC-90. Mineralization was intersected consistently between 400 and 800 m depth and could represent a significant new gold zone (within the dike mineralization, true width is not known);

Holes PC-91 and -94 also intersected the high-grade zone returning intercepts of up to 8.5 g/t Au over 3.5 metres and 9.7 g/t Au over 4.2 metres, respectively (within the dike mineralization, true width is not known);

Continuity of near-surface mineralization continues to be demonstrated with some impressive intervals in the first 150 m of depth, with the best intercept returning two g/t Au over 143 metres, including 35.1 g/t Au over 4.2 metres, in hole PC-90 (true width approximately 70 per cent to 90 per cent of drill interval).

The new gold zone was intersected by an infill drill hole, DDH PC-90, which was originally designed to test for higher-grade mineralization within the east-west-trending quartz-tourmaline vein system. At approximately 400 metres depth (downhole) a north-south-trending diorite dike containing numerous zones of significant disseminated pyrite mineralization and quartz-tourmaline veins, similar to that hosting the former Beliveau mine, was intersected and traced down to over 800 m depth downhole. The true width of these zones is not known and will require further drilling to determine. The presence of strong gold mineralization in the diorite dike at these depths indicates that the east-west feeder system is active at these levels and bodes well for further expansion along strike, away from the dike, at these depths. In addition to the new zone, the higher-grade quartz-tourmaline vein mineralization originally targeted was also intersected at shallow depths in hole PC-90, returning an impressive two g/t Au over 143 metres starting at 15 m depth (downhole). Other highlights of the near-surface vein system include: 2.5 g/t Au over 25.5 metres in hole PC-86 and three g/t Au over 16.0 metres in hole PC-88. Results from this first-phase drilling program are very encouraging and indicate increased potential for both near-surface bulk-tonnage and deeper, higher-grade mineralized systems. Results also demonstrate the continuity of the gold mineralization and therefore the potential for significant new mineralization laterally to the west and east of the known mineralization.

VAL D’OR EAST PROJECT DRILLING RESULTS

Hole From To Length Au

(m) (m) (m) (g/t)

PC-16-84 45.5 62.2 16.7 1.5

including 52.9 54.9 2.0 9.5

134.0 140.0 6.0 2.9

PC-16-85 101.0 158.9 57.9 1.1

including 148.8 150.5 1.7 9.0

PC-16-86 41.5 67.0 25.5 2.5

including 45.5 48.1 2.6 14.6

85.0 90.0 5.0 3.9

102.7 144.0 41.3 1.0

153.4 156.0 2.6 6.9

PC-16-87 131.5 149.5 18.0 2.4

including 139.5 142.0 2.5 11.2

PC-16-88 166.0 182.0 16.0 3.0

including 168.0 171.0 3.0 15.0

PC-16-89 13.0 36.6 23.6 0.8

PC-16-90 14.8 157.8 143.0 2.0

including 14.8 27.3 12.5 7.0

including 94.4 98.5 4.2 35.1

437.5 450.0 12.5 2.6

524.4 535.8 11.4 3.2

586.4 593.7 7.3 12.6

637.8 648.5 10.8 3.1

657.8 663.6 5.8 5.3

669.5 678.0 8.5 3.5

710.4 717.5 7.1 4.7

PC-16-91 150.7 152.8 2.1 14.6

476.1 483.6 7.5 3.8

518.3 521.3 3.0 6.3

680.5 684.0 3.5 8.0

PC-16-92 392.0 394.3 2.3 19.5

PC-16-93 100.3 105.3 5.0 3.2

PC-16-94 15.7 155.0 139.3 0.7

including 17.7 25.7 8.0 6.2

529.6 540.6 11.0 4.8

649.7 651.7 2.0 8.2

641.0 664.1 23.1 3.1

including 661.6 664.1 2.5 12.9

690.5 693.3 2.8 5.1

728.0 731.0 3.0 5.1

808.9 813.1 4.2 9.7

PC-16-95 14.8 19.3 4.5 2.6

136.9 141.8 4.9 2.8

163.8 168.0 4.3 3.4

254.0 263.0 9.0 3.9

PC-16-96 164.9 167.0 2.1 10.9

(1) For intervals within diorite, true thickness is not

known. Additional drilling is planned for the immediate

area which will enable the true width determination.

(2) For all other rock types, true thickness is currently

estimated to be between 70 per cent and 90 per cent of

drill length.

Dr. David Palmer, president and chief executive officer of Probe, stated: “Initial results from the drilling program have definitely validated our confidence in the Val d’Or East project and highlighted its significant exploration upside and potential for expansion. To come up with a new discovery so soon after the combination of Probe and Adventure Gold is not only a testament to the project but also the dedication of the new exploration and management team. We look forward to continuing the success on Val d’Or East, as well as our other projects, as we ramp up our exploration activities. With the bulk of our land consolidation strategy achieved, we will now be able to focus more effort on our exploration programs and generating results.”

Following the discovery of the new zone, surface drilling has been expanded to better delineate this mineralization and test for its extensions. Two drill rigs are currently in operation on-site testing the new zones. The results announced today are from 5,600 metres of drilling, representing 13 drill holes. Drill results from the continuing drill program will be disclosed as they become available.

In addition to drilling, the first phase of a property-scale induced polarization survey has been completed and is currently being interpreted. The company intends to commence drill testing of the new IP anomalies in first quarter 2017 with the addition of a third drill.

The New Beliveau gold deposit

The New Beliveau deposit consists predominantly of a series of parallel, east-west trending, moderately dipping to the south-mineralized zones hosting gold-bearing quartz-pyrite-tourmaline veins. Gold mineralization occurs in the veins but also in their immediate wall rocks. The sulphide content is generally 1 to 5 per cent, but may reach up to 10 per cent in the higher-grade sections. The extent of the alteration zone, which consists of a mixture of quartz, tourmaline, dolomite, albite and euhedral pyrite, is commonly twice the thickness of the vein itself. The north-south-trending diorite dikes also contain significant gold with gold grades typically increasing in areas where the dikes are intersected by the east-west quartz-tourmaline veins. Wall rocks for both systems consist of intermediate volcanics rock.

Together with the Highway and North zones, the New Beliveau deposit hosts a National Instrument 43-101 inferred resource of 770,000 ounces at 2.6 g/t gold calculated at a one g/t cut-off above 350 metres depth and 1.5 g/t cut-off below 350 metres depth (see NI 43-101 technical report “Mineral Resource Val-d’Or East Property,” Jan. 4, 2013).

Qualified persons

The scientific and technical content of this press release has been prepared, reviewed and approved by Marco Gagnon, PGeo, executive vice-president of Probe, and Denis Chenard, PEng, senior geologist of Probe, at the Val d’Or East project, who are qualified persons as defined by National Instrument 43-101.

Quality control

During the last drilling program, assay samples were taken from the NQ core and sawed in half, with one-half sent to a certified commercial laboratory and the other half retained for future reference. A strict quality assurance/quality control program was applied to all samples; which includes insertion of mineralized standards and blank samples for each batch of 20 samples. The gold analyses were completed by fire assay with an atomic absorption finish on 50 grams of materials. Repeats were carried out by fire assay followed by gravimetric testing on each sample containing five g/t gold or more. Total gold analyses (metallic sieve) were carried out on the samples which presented a great variation of their gold contents or the presence of visible gold.

About Probe Metals

Probe Metals is well financed and controls a strategic land package of over 1,000 square kilometres of exploration ground within some of the most prolific gold belts in Ontario and Quebec: Val d’Or, West Timmins, Casa-Berardi and Detour, Quebec. The company is committed to discovering and developing high-quality gold projects, including its key asset the Val d’Or East gold project. Goldcorp currently owns a 15-per-cent stake in the company.

We seek Safe Harbor.

Comment by Jon - BMR — December 6, 2016 @ 6:31 am