Gold has traded between $1,188 and $1,200 so far today…as of 9:30 am Pacific, Gold is up $4 an ounce at $1,195 and should continue to benefit from the more chaotic world we’re now in…Silver is flat at $17.11…Copper is down slightly at $2.64…Nickel has jumped 11 cents to $4.40…Crude Oil has retreated 38 cents a barrel to $52.79 while the U.S. Dollar Index has added one-fifth of a point to 100.54…

Gold investors need to keep an eye on India this week as the Modi government releases its 2017 budget on Wednesday amid terrible headwinds, mostly caused by the Prime Minister’s disruptive decision to invalidate more than 80% of India’s currency last November…there has been speculation that the Finance Ministry could cut the 10% Gold import tariff, though HSBC analysts say they have low expectations for such a reduction. “But if the ministry announces a cut, we would expect Gold to move higher, as India is a key physical demand market for bullion,” HSBC said…

Gold investors need to keep an eye on India this week as the Modi government releases its 2017 budget on Wednesday amid terrible headwinds, mostly caused by the Prime Minister’s disruptive decision to invalidate more than 80% of India’s currency last November…there has been speculation that the Finance Ministry could cut the 10% Gold import tariff, though HSBC analysts say they have low expectations for such a reduction. “But if the ministry announces a cut, we would expect Gold to move higher, as India is a key physical demand market for bullion,” HSBC said…

New Gold’s (NGD, TSX) share price took a significant hit today after the company reported that initial production from its Rainy River mine in Ontario would be delayed by 3 months and that it would cost $195 million more to bring the project online…

China Dials Up The Rhetoric

China is preparing for a potential military clash with the United States, according to an article on the Chinese army’s website. “The possibility of war increases as tensions around North Korea and the South China Sea heat up,” Liu Guoshun, a member of the national defense mobilization unit of China’s Central Military Commission, wrote on January 20 – the same day as President Trump’s inauguration. “A war within the President’s term, ‘war breaking out tonight’, are not just slogans, but the reality,” Liu said in the Chinese commentary piece…

Nothing like a little military confrontation to get Gold and Oil humming…

Crude Oil Update

Oil prices are under mild pressure today as news of another increase in U.S. drilling activity spread concern over rising output just as many of the world’s Oil producers are trying to comply with a deal to pump less in an attempt to prop up prices…the number of active U.S. Oil rigs rose to the highest since November 2015 last week, according to Baker Hughes data, showing drillers are taking advantage of prices above $50 a barrel…

The Saudis are determined to do what they can to keep Crude Oil prices firm in 2016 ahead of a massive IPO of their state Oil company, Aramco…Saudi Deputy Crown Prince Mohammedbin Salman has said Aramco is worth between $2 trillion and $3 trillion…analysts say a public listing of 5% of Aramco could fetch between $100 billion and $150 billion, the most ever for an IPO…the Wall Street Journal has reported that the kingdom hired an energy consultant last year to assess its reserves of Crude Oil, opening a window to a closely guarded secret ahead of the IPO…the audit is a prerequisite for listing Aramco which could happen as soon as next year…the size of Aramco’s reserves will play a crucial role for investors in determining the worth of what some call the world’s most valuable company…

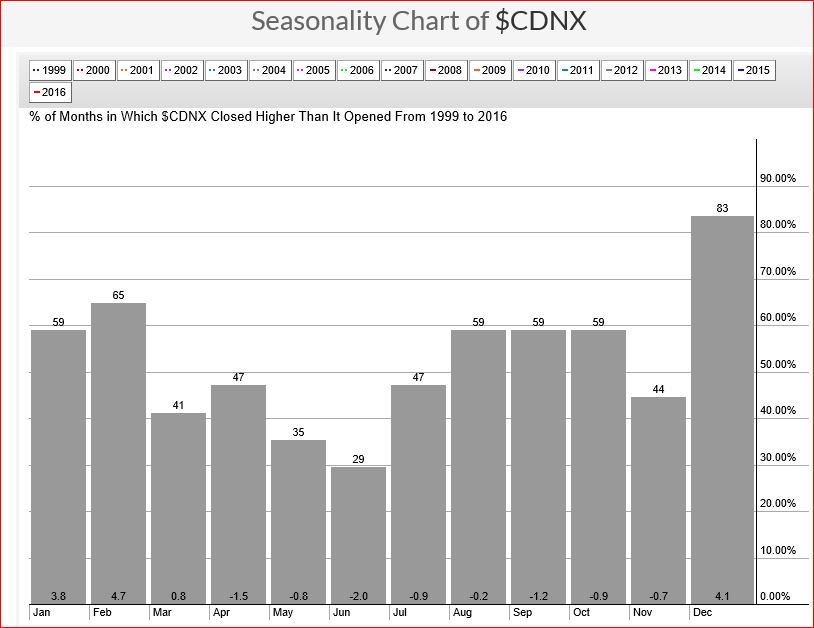

Venture Seasonality Chart

It’s rare for the Venture to have a bad or even mediocre February, so make sure you’re well-positioned now in order to capitalize on some profit opportunities in the month ahead…

As you can see in John’s seasonality chart, February has been the Venture’s best month on the calendar going back nearly 2 decades in terms of total returns…February’s average gain of 4.7% has outpaced that of December (4.1%) and January (3.8%), the other 2 strongest months of the year…

February is an “up” month two-thirds of the time – only December has been better (>80%) in that regard…

Venture Long-Term Chart

This Venture long-term chart demonstrates just how powerful this new bull market is…amazingly, far too many retail investors haven’t even recognized that the Venture commenced a new bull cycle early last year and that the Index started a new leg up in that cycle toward the end of December…

Note the breakout above the long-term downsloping channel, the +DI/-DI bullish cross, the strong reversal to the upside in the 300-day moving average (SMA), and the RSI(14) surge…the next big thing to watch for is an RSI(14) breakout above the long-term downtrend line going back a decade…

For reasons that few people may understand, this chart is telling us that Gold prices and/or commodity prices in general could soar anytime within the next 12 months…

In Today’s Morning Musings…

1. “Sweet Home Colorado“…

2. Very important pattern forming on Silver’s short-term chart…

3. “Probing” in on a potential multi-million ounce Gold discovery at Val d’Or East…

4. Stay Zealous for Zeolite!…

5. Daniel’s Den – food for thought!..

SAVE 25% on our January Special, ending soon, with a risk-free BMR Basic, Gold or Pro Subscription TODAY – and we’ll show you our proprietary strategies that have delivered unbeatable documented triple-digit returns.

With an industry-leading 100% money-back satisfaction guarantee for new subscribers, you can enjoy unlimited access to all BMR content with a PRO membership.

Sign up NOW or login as a current subscriber with your username and password.

BullMarketRun.ca

BullMarketRun.ca

GGI nr.

Comment by Laddy — January 30, 2017 @ 1:36 pm

Jon, what are your thoughts on the GGI nr.

Comment by pole — January 30, 2017 @ 2:30 pm

CXO – I missed loading up at lower levels. Going to try and buy some around here.

Comment by Dennis — January 30, 2017 @ 2:38 pm

Certain things you must have, Laddy and Pole, for a major Nickel-Copper massive sulphide system, and that checklist is almost complete for GGI’s E&L after today’s post-market news – an amazing geological story unfolding in this high-grade Gold-Silver-Cu-Au porphyry camp…

Source of sulphur – that’s critical for metal enrichment…absolute MUST!! for a high-grade Ni-Cu massive sulphide system…Hazelton Group shales have provided that sulphur source at the E&L…ka-ching!…that’s huge…

A gravity anomaly – just about every major Ni-Cu-PGE discovery has been associated with a gravity high…if there wasn’t one at the E&L, that would be a matter of concern…now we know that the existing deposit is on the flank of a massive regional gravity high 35 km x 15 km…interestingly, VOISEY’S BAY is also on the flank of a gravity high!!!!…another gravity high (linear, north-south) flanks the eastern border of the E&L…the fact these gravity highs “truncate” the NW-SE regional fabric suggests, as GGI indicates, the likelihood that there has been a dynamic mafic-ultramafic magmatic event…ka-ching!

The “Eskay Rift” is what is so important to understanding the Eskay Creek deposit…looks like there is also an “E&L Rift” that has allowed the mafic melts to come through…potential BIG VOLUME event which is what you want to see…ka-ching!

The high tenors are world class (4.8% Ni to 8% Ni and 2.1% Cu to 10.9% Cu)…you need tenor!!!!!! that’s another check…ka-ching!

The “Q” magnetic anomaly and the 600-m long conduit shaped keel…magma chamber???…ka-ching!

A known deposit with massive sulphides…3 million tonnes (historical), that’s not insignificant…this could easily be a mine with 10 million tonnes and a nice high-grade core that delivers around 2% Ni…ka-ching!

If you look at the district map, you’ll see that the E&L is pretty much in the middle, in the heart, of this Camp…on trend with Snip and Brucejack…the tectonic code is being unlocked…increasingly, the inner core of the Camp looks like a large and high-grade Ni-Cu massive sulphide system due to a rift and a major magmatic mafic-ultramafic event…ka-ching, ka-ching, ka-ching!!!…interestingly, there’s also a mafic intrusive on Eskay Mining’s property just to the east of the E&L…some Nickel was also hit on ESK’s land package in 2009 but was never followed up on…the outer part of the Camp is clearly high-grade Gold…Gold-Copper porphyry on the inside of the high-grade Gold…

The only thing I see that GGI does not have at the moment are some big conductors for no-brainer drill targets into interpreted massive sulphides…the only reason for that is that there has not been any modern geophysics at the E&L, which can see down to 300 to 400 m…best time to do a VTEM is when it’s cold and the fly weather is good…I suspect they’ll be doing VTEM ASAP…everything else checks…massive sulphides will be picked up on the VTEM…

Fascinating…that’s why Dr. Raymond Goldie is now saying there is no other property in Canada right now that is more prospective for a major Ni-Cu-PGE massive sulphide discovery than the E&L…he’s a Nickel expert, he should know…more with him this week.

Just imagine for a moment, the significance of a world class Ni-Cu-PGE discovery in the heart of this particular Camp if such a thing should occur!!

This is the kind of information that can make you awfully rich if you have that “light bulb” moment! Northern Shield went to a $60 million market cap last summer on nothing compared to what GGI now has at the E&L…so that should tell you where GGI is headed…

The 3D geologic model will allow everyone to visualize what is unfolding here…

This news also makes MTS and CXO even more interesting…

Comment by Jon - BMR — January 30, 2017 @ 2:49 pm

Add shortly to the end of that.appears he wants to keep the nr’s consistent, that’s good.

Comment by Laddy — January 30, 2017 @ 3:15 pm

Thanks Jon for that great explanation of the GGI nr. Now I have a much better understanding of what is truly unfolding at the E&L. WOW!

Comment by pole — January 30, 2017 @ 3:31 pm

“Wow” is not even a word that does justice to this, pole…you look for strong, powerful evidence – it’s all there…and ask yourself this, does it make sense that this district, which has already produced Eskay Creek, Brucejack, KSM and Snip, could also host a Voisey’s Bay type deposit? Damn right it could – makes PERFECT sense, actually, especially now that we understand the tectonic component of this Camp so much better…this is why Makela and Goldie have jumped in and are so excited…this is just the start—-it’s going to get NUTS…

I think the E&L 3D model from GGI is going to make people’s heads spin and their eyes pop out…I’m imagining something really cool and big that shows the original deposit like a toothpick compared to what’s around it…

Comment by Jon - BMR — January 30, 2017 @ 3:42 pm

Jon, excellent summary. I said from the beginning, we need conductors to better understand what may exist on the property.. Can they actually produce a 3D model without picking up some conductors? Regoci said the 3D model will be ready very shortly. Is it possible that a VTEM has already completed? The fuse is about to be lit at E&L.

Comment by Dan1 — January 30, 2017 @ 4:55 pm

Jon, to add to your comparison between NRN and GGI. NRN went to 60 million market cap on 200 million outstanding shares. GGI has only 72 million outstanding. So, GGI could go much much higher on speculation.

Comment by Dan1 — January 30, 2017 @ 5:04 pm

Jon

Whats the word out there with CXO, no news and up 5.5 cents today on over 1 million shares, they cant start drilling yet in the Heart of gold camp, just surprising to see the big jump today…

Comment by Gregh — January 30, 2017 @ 5:26 pm

We expected a move into the 30’s on CXO this month, Greg, based on 3 things: 1) chart strength (key breakout above .26); 2) Green Springs Nevada property which gives CXO that year-round exploration dynamic which it was missing last year; and 3) a growing realization, based on the recent details provided by CXO, that last summer’s KSP program was far more successful geologically than the market originally understood late last summer/early fall.

If you recall, CXO’s run last year on KSP started at the end of February, well before drilling, so in 2017 the stock is about a month ahead of that pace. It’s going to happen with GGI and some other plays in the Camp, as well, very soon. Investors are going to wake up one morning and suddenly the sale is over. Then they’ll be chasing higher prices.

Comment by Jon - BMR — January 30, 2017 @ 6:30 pm

Thanks Jon for all of the above GGI and CXO good stuff…

Comment by GREGH — January 30, 2017 @ 6:41 pm

DBV – Jon, good volume on DBV again today. Subscribers have not seen an update on the Chad Day suspension since you broke that news. Seeing the news release that Chad Day seemed to have signed with CXO makes it look like he is back to work. What knowledge of that situation can you share and update with us? When I last asked, you had mentioned more in the new year on that and now January is gone. TIA

Comment by vepper — January 30, 2017 @ 7:45 pm

DBV needs to get thru .10, Vepper, and on volume…as far as Chad Day goes, he refused to reply to our repeated requests for a Q&A given information we have, and we are still deliberating our approach with regard to that…we’ll report the facts as we get them. We have become so busy, I’m not too keen on wasting time with Chad, quite frankly. Nothing has fundamentally changed with regard to the Sheslay district since Farshad won the injunction. Chad would be very foolish to try to mess around with DBV again, believe me.

Comment by Jon - BMR — January 30, 2017 @ 8:19 pm

GGI – Goldie clip on the web https://youtu.be/weVHoQPcA14

Comment by david — January 30, 2017 @ 9:12 pm

Jon

Couldn’t hurt if you reminded everyone why Chad Day did the blockade in the first place at the precise time he did it with the Tahltan Drilling crew doing the drilling… nothing has changed except more drilling since then and hopefully even better results?

Comment by GREGH — January 30, 2017 @ 9:30 pm

Jon

any idea of how big the gravity high was at Voisey’s Bay?

Comment by GREGH — January 30, 2017 @ 9:45 pm

The Voisey’s Bay gravity high is actually not as big on a regional scale as the 2 gravity highs flanking the E&L deposit, Gregh, and I just got that from speaking with one of the top geophysicists in the country. This is fascinating about the gravity anomalies, another important part of that key checklist that includes a sulphur source, tenors, etc. The denser the rocks, the better it is, and gravity anomalies provide those clues and are a must for nickel-copper massive sulphide deposits, foundation data. The E&L gravity signature is in a strikingly similar position as Voisey’s Bay…with the deposits in both cases on the flank of a gravity high. Just an intriguing coincidence or is there more to that? We honestly don’t know. Anyway, the key is the existence of the 2 massive gravity anomalies flanking the E&L deposit and obviously including the Q anomaly and a very broad area. This is real—-VERY real, at a whole new level than what was known even just recently. The 3D model could blow the lid off GGI.

Comment by Jon - BMR — January 30, 2017 @ 10:30 pm

Jon

thanks for all the info tonite on GGI, was wondering if you have spoke to Regoci lately and if you have any vibes or insight from him?

thanks

Comment by GREGH — January 30, 2017 @ 11:21 pm

CNZ news this morning….CANADIAN ZEOLITE ANNOUNCES DISTRIBUTION DEAL WITH CANADIAN DISTRIBUTOR

Comment by Foz1971 — January 31, 2017 @ 6:58 am

NR from CASTLE SILVER RESOURCES (CSR): Excellent silver- cobalt recoveries and concentrate grades in first stage bench-scale metallurgical testing of Beaver Mine mineralized material samples and tailings samples from both Beaver and Castle Mines.

Jon: any comment?

Comment by rgiroux — January 31, 2017 @ 7:01 am